Digital Wallets: A Comprehensive Overview

Digital wallets, also known as e-wallets or mobile wallets, are virtual wallets that allow users to store and manage their payment information securely on their smartphones or other electronic devices. These wallets have gained popularity in recent years due to their convenience, security, and ability to streamline the payment process. In this summary, we will explore the features, benefits, and potential risks associated with digital wallets.

Features and Functionality

Digital wallets typically offer a range of features that make them convenient and user-friendly. Some common features include:

Payment Integration: Digital wallets can be linked to various payment methods, such as credit or debit cards, bank accounts, or even cryptocurrency wallets. This integration allows users to make payments directly from their digital wallets without the need to carry physical cards or cash.

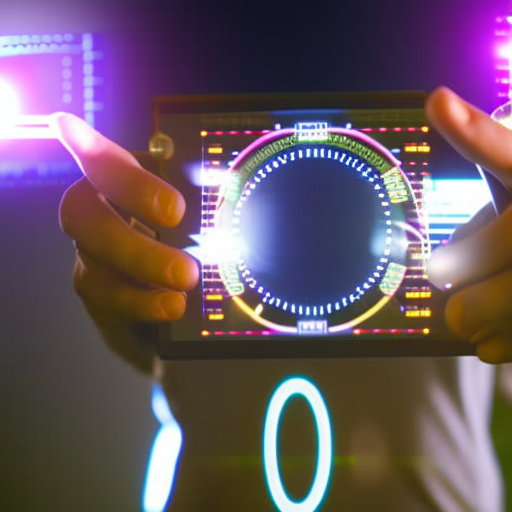

Contactless Payments: Many digital wallets support Near Field Communication (NFC) technology, enabling users to make contactless payments by simply tapping their smartphones on compatible payment terminals. This feature has become increasingly popular, especially in retail and transportation sectors.

Secure Storage: Digital wallets use encryption and other security measures to protect users’ payment information. This ensures that sensitive data, such as credit card numbers, are stored securely and are not accessible to unauthorized individuals.

Transaction History: Digital wallets often provide users with a detailed transaction history, allowing them to track their spending and review past purchases. This feature can be particularly useful for budgeting and expense management purposes.

Benefits of Digital Wallets

Digital wallets offer several benefits to both consumers and businesses:

Convenience: With a digital wallet, users can make payments quickly and easily, without the need to carry physical cards or cash. This can be especially beneficial in situations where speed and efficiency are essential, such as during busy shopping periods or when traveling.

Security: Digital wallets employ advanced security measures, such as tokenization and biometric authentication, to protect users’ payment information. This reduces the risk of fraud and unauthorized access to sensitive data.

Rewards and Loyalty Programs: Many digital wallets offer rewards and loyalty programs, allowing users to earn points or cashback on their purchases. These incentives can encourage customer loyalty and provide additional value to users.

Integration with Other Services: Digital wallets can integrate with other services, such as ride-sharing apps or online marketplaces, making it easier for users to make payments within these platforms. This seamless integration enhances the overall user experience and simplifies the payment process.

Potential Risks and Concerns

While digital wallets offer numerous benefits, there are also potential risks and concerns that users should be aware of:

Security Breaches: Despite the robust security measures implemented by digital wallet providers, there is always a risk of security breaches and data theft. Users should ensure they use strong passwords, enable two-factor authentication, and regularly update their digital wallet applications to minimize these risks.

Loss or Theft of Device: If a user’s smartphone or electronic device is lost or stolen, there is a risk that unauthorized individuals could access their digital wallet and make unauthorized transactions. Users should take precautions, such as enabling device lock features and remote wiping capabilities, to mitigate this risk.

Compatibility and Acceptance: While digital wallets are becoming increasingly popular, not all merchants or service providers accept payments through digital wallets. Users should ensure that the places they frequent support the use of digital wallets before relying solely on this payment method.

Conclusion

Digital wallets have revolutionized the way we make payments, offering convenience, security, and integration with other services. With their ability to store multiple payment methods, make contactless payments, and provide transaction history, digital wallets have become an essential tool for many consumers. However, users should remain vigilant about the potential risks associated with digital wallets and take appropriate measures to protect their payment information. As technology continues to evolve, digital wallets are likely to become even more prevalent, further transforming the way we handle our finances.